With a tagline “with you, right through” HDFC promises to be with their customers right though his life. It would not be out of place to say HDFC has been with their investors too – “ with them, right through” for many years now creating enormous wealth through business excellence under a visionary management.

HDFC, a top wealth creator with a stellar track record spanning 4 decades becomes the first scrip we add to our accumul8 portfolio.

While we do not intend to do a stock analysis for the trades done in accumul8, here are the reasons why we like the stock.

HDFC becomes the first scrip we add to the accumul8 portfolio.

Please find below the screen shot of the actual BUY trade for HDFC for accumul8 Portfolio.

accumul8 Trade details

Reasons to invest

1. Financial Conglomerate with string of pearls

A picture is worth a thousand words. The below infographic highlights the crown jewels in HDFC’s portfolio.

By owning HDFC you indirectly get to own:

HDFC Bank

HDFC Life

HDFC Asset Management

HDFC ERGO

HDFC CREDILA

Other investments

Each of them is a market leader or in the top 3 in their vertical / space. Almost 50% added to the bottom line by the group companies:

*Additionally HDFC owns 9.89% stake in Bandhan Bank post Gruh Finance merger with Bandhan Bank.

2. Standalone Business

Coming to the core of their stand-alone business. There is so much to love about this company.

A) Management team of the highest Quality

Firstly, retail investors must realize that as minority shareholders need to evaluate the management carefully. It takes a lot to be ethical, fair, and most importantly share wealth with minority shareholders. I believe if you find an honest, transparent, and ethical management who are above average then you should lap up the shares of that company.

When they have all these values and are also happen to the best of breed in execution, visionary and with a long track record of out-performance and if there is a chance being offered to buy a small portion of that company then you should not think twice.

Even in the peak of real estate boom in 2006-2008, when teaser loans were done by everyone in the industry, HDFC stayed away from this practice. This speaks volumes about the culture, quality of the management and the “long term” outlook rather than any short-termism exhibited by many corporates today where companies follow window dressing, follow the herd and all other kind of practices so that they are not left behind.

B) Core Business

Coming to the second most important aspect of your investing decisions - Business prospects. HDFC’s core business caters to one of the fundamental aspirations of an Indian - Owning a House.

Roti, Kapada aur Makaan

When the former prime minister popularized the slogan “Roti, Kapada aur Makaan” (Food, clothing and shelter) before the 1967 general elections, she was addressing a core need of the human psyche and the underlying aspirations of millions.

Makaan or Shelter / house has been one of the need / aspirations / dreams of the burgeoning middleclass for a while now. HDFC, since 1978 for the last 38 years has been addressing this very core need of every Indian.

HDFC’s main business- mortgages is robust growth engine which has withstood the test of time for the last 38 years and here are a few thoughts.

There are few things worth highlighting.

Simple, Single product business- Unlike many financial institutions who have a plethora of offerings like bank accounts, insurance, credit lines, investment advisory and I can go on….in the case of HDFC it’s a single product – Home Mortgages. The entire company entire organization machinery is geared to deliver on one product focuses on that and they do it very well.

Harnessing the power of HDFC Bank to drive growth- There are many things which are in hindsight great piece of strategic decision. HDFC Bank does not offer home loans but instead sources home loans for its parent for a fee.

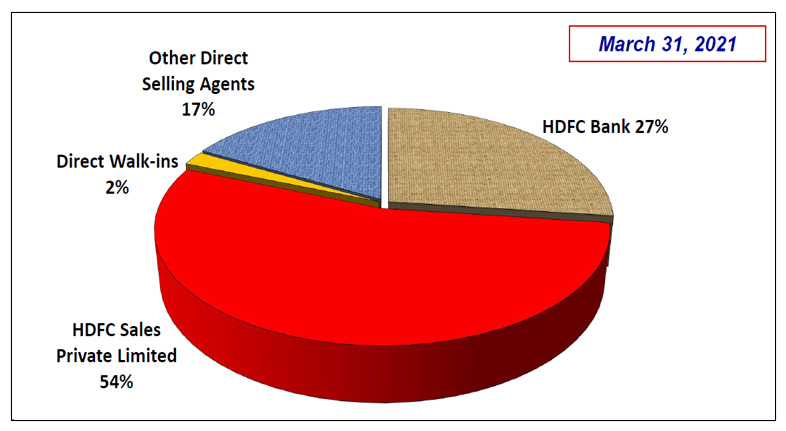

Having such a strong performer like HDFC Bank with its laser like focus to grow business working for you it is no surprise that they are the market leaders. Last year 27% of the loan accounts were sourced by HDFC Bank.

Share of HDFC Bank in Loan sourcing

3. Long runway for growth with strong tailwinds

A) Low penetration

The below infographic clearly shows that mortgages as percentage of nominal GDP is still very low compared to other developing and developed countries implying a long runway for growth if the company manages to retain its competitiveness.

B) Regulatory and Government tailwind

There has been a concerted effort by the Government and regulators to make housing more affordable by various tax incentives and policy initiative which are demand drivers for the company

Income tax rules for housing loan interest and principal for home loan borrowers

Interest rate subsidy for Lower Income Group (LIG) and Economically Weaker Sections (EWS)

Refinance schemes for NBFC- housing companies

“infrastructure” status accorded to affordable housing.

Rupee denominated bonds for External borrowing.

C) Urbanization and Demographics

The biggest advantage our country is enjoying is what we call as “demographic dividend”. More that 60% of the country is less than 35 years old which implies a large potential market for home loans.

Also with increasing urbanization, growth in nuclear families and rising income the demand will only go up

Lastly, every holding company globally trades at a discount and is generally referred to as “holding company discount”. Globally Holding companies trade at 10 to 30% discount but in India it is usually high ranging above 50% with the exception of HDFC where the holding company discount is closer to the global average.

Final Thoughts

“Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily understandable business whose earnings are virtually certain to be materially higher five, ten and twenty years from now. Over time, you will find only a few companies that meet these standards - so when you see one that qualifies, you should buy a meaningful amount of stock”

-Buffett in 1996 share holder letter.

HDFC fits the description perfectly and enters as the first script in accumul8 Portfolio. Incidentally, HDFC qualifies to be a Punchcard stock too.

Subscribe Now

Dear Investor,

This being the first issue is FREE to read. Going forward you need to subscribe to “Follow the accumul8 Portfolio”.

You can read more about accumul8 Portfolio here