Power of Equities

Wealth through Long term investing

“The Single greatest edge an investor can have is a long-term orientation”

- Seth Klarman

It is a lovely morning, and you are woken by the flying seagulls above. Lying on the deck of the yacht you see the vast expanse of the blue sea and the shoreline in the distant horizon. As you move to the bow of the yacht, the skyscrapers become visible.

Sipping on your cappuccino, your mind goes back to a few decades when you had lived very close to those skyscrapers. The memories come gushing by -

You used to wake up to the whistle of the pressure cooker from your kitchen and as soon as you wake up you remember the nightmare lined for the day – a review meeting planned with your boss. To make matters worse you need to start an hour early to beat the bumper-to-bumper city traffic. If this was not enough, as you rush to get freshened up, you find your two children fighting as to who would use the washroom first.

Friends, while this may sound dramatic – there is an element of truth hidden in this. In our prime, we put in the hard hours, endure a lot of hardship with a hope that our latter years will be like Mr. Sunny mentioned above holidaying on a yacht.

The Superinvestors of Graham and Doddsville

If you thought this was a fiction of my mind or a scene from a Hollywood movie then you are mistaken. Here is what Warren Buffett wrote on similar lines in his 1984 masterpiece “The Superinvestors of Graham-and-Doddsville” about Tom Knapp:

You too can own the beach, but for that you must remember your “Grahams and Doddsville” – Invest in Equities for the very long term.

Why Equity?

Morgan Stanley published a study few years ago comparing post tax CAGR returns across asset classes in India over 5, 10, 15 and 20 years. Unsurprisingly, equities beat Indian favorites: ‘Gold’ and ‘Property’ comfortably.

Equities: The Best Performing Asset Class

Globally multiple studies have found that equities is the best performing asset class. 120 years study spanning couple of centuries by Credit Suisse confirms the fact that equities are a source of long term wealth creation.

Power of Patience

NIFTY50 is up 14 times in 25 years crossing the 15000 points mark now. This shows that even above average returns or mimicking the index would have made you wealthy.

Investor’s Edge

“Investing is where you find a few great companies and then sit on your ass.” Charlie Munger

If we are not investing in a mutual fund or in the index and wish to pick stocks, then a key question one need to answer for ourselves “What is my edge?”.

Everyone loves a multi-bagger. Even better a 10 bagger. How about a 100 bagger? Well, if you wish to multiply your capital 100 times then this table might help:

Number of years to a 100 bagger

As you can see from the table above that even if you manage to find an investment that gives you 20% annual returns you would need 25 years (read that again TWENTY-FIVE YEARS) to multiply your investment 100 times.

Philip Carret, one of the greatest investors of our time, one who had seen and experienced 31 bull markets, 30 bear markets and 20 recessions in an investing career that spanned 70 years (until age 101) was asked by a journalist as to what he considered as the most important thing needed to succeed in the stock market. He just said one word “Patience”.

Patience + Skill = Immense Wealth

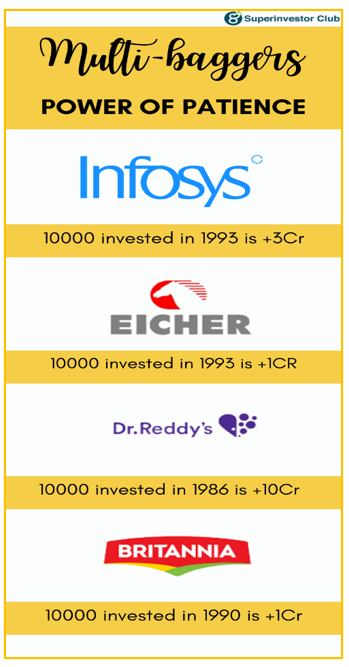

Patience is power of compounding in disguise. Ignore survivorship bias and look at he table below.

As you can see how an amount of Rs 10000 invested in a fundamentally sound scrip with good economic characteristics and most importantly held for a longer period (+25 years) has multiplied 100 times and is worth more than a crore today.

Key to finding Multi-baggers

Thomas Phelps in his Seminal Book ‘100 to 1 in the Stock Market’ has this to say on finding a 100 bagger:

“To make money in stocks, you must have vision to see, courage to buy and patience to hold. Patience is the rarest of the three.”

Each of the stock in the below infographic is a 100 bagger.

Many of us will have bought these scrips at different phases of the stock’s 100 bagger journey. Only a handful would have held on to them to multiply their capital 100 times.

Final thoughts

Equities is a tool for immense wealth creation. Paraphrasing what Buffet said : Wealth creation through equities is simple but not easy. All you require is a 4th grade Math and average intelligence, but the key is to have emotional quotient and the willingness to get rich slowly.

PS : If you are ready to get rich slowly but surely, do check out accumul8 Portfolio Information Service.